Related Document

Spanish Mountain Gold Ltd. (the “Company”) (TSX-V:SPA) is pleased to announce the results of the Preliminary Economic Assessment (the “PEA”) for the pit-delineated high grade core (the "First Zone") of the 100% owned Spanish Mountain gold project (the “Project”) located near Likely in central British Columbia, Canada. The PEA, the commencement of which was announced in a news release dated February 14, 2017, has been prepared in accordance with NI 43-101 Standards of Disclosure for Mineral Projects.

As disclosed in the previous news release, the PEA is based on a 20,000 tonnes per day (tpd) processing rate with a streamlined flowsheet to process the Measured and Indicated Resources within the First Zone. Please refer to Section 1 below for details of the proposed operation.

Highlights of the PEA are as follows:

- At the proposed 20,000 tpd throughput, the First Zone has a project life of 24 years and a total life of mine (LOM) production of approximately 2.2 million ounces of gold and 1.5 million ounces of silver.

- The initial capital expenditure is expected to be C$507M (or US$380M) including a contingency of C$51M. The sustaining capital over the life of the mine is estimated at C$194M

- At an assumed LOM gold price of US$1,250 per ounce (the base case), the First Zone generates a pre-tax NPV (@5%) of C$597M and a post-tax NPV of C$482M. Pre-tax and post-tax Internal Rates of Return are 21% and 19%, respectively. Payback of capital is expected to be less than four years.

- Selected operational and cost metrics for Years 1 - 5; Years 1 - 10 and LOM are as follows:

| Units | Years 1 - 5 Avg. | Years 1 - 10 Avg. | LOM | |

|---|---|---|---|---|

| Gold grade | g/t | 0.77 | 0.69 | 0.43 |

| Strip Ratio | 0.96 | 1.55 | 1.44 | |

| Annual Gold Production | koz | 157 | 142 | 92 |

| Cash Cost/ oz | US$ | 469 | 555 | 595 |

| All-in-sustainable Cash Cost | US$ | 533 | 619 | 659 |

| Total Cost/ oz | US$ | 667 | 752 | 792 |

Larry Yau, CEO, commented: “Once again our team's diligence has delivered impressive results for our shareholders. I believe that this PEA has convincingly validated our two-zone project approach for advancing our multi-million ounce resource: the First Zone alone generates robust investment returns and an operation lasting 24 years whereas the Second Zone, comprised of additional multi-million ounces of gold within the current geologic resource estimate, largely as Inferred Resources, potentially adds development flexibility and leverage on the future gold price.

“While there have been numerous improvements since the 2012 PEA, a few key comparisons highlight the excellent progress our team has made in demonstrating the robust economics of our project as follows:

- Compared with the previously (2012) estimated NPV (@5%) for the entire resource, the PEA has achieved an NPV for the First Zone alone that is up to 63% higher even at a gold price that is US$210 lower than assumed for the 2012 PEA

- Post-tax IRR has increased from 12% to 19%

- Initial capital has decreased by up to C$257M (or 33%) from C$764M to C$507M

- LOM All-in-sustainable Cash Cost per ounce has decreased from US$834 to US$659

- Project life for the First Zone extends 24 years vs. 13 years for the entire resource in the 2012 PEA

The noted improvements to project economics are the result of focusing the study on a lower throughput, smaller footprint and smaller impact Project.

We believe the current PEA provides a reasonable basis for the Company to advance the Project in the present gold price environment.”

Please refer to the Company’s redesigned website for additional details on the new PEA and the project: www.spanishmountaingold.com

Section 1: Proposed Operations

The mine plan adopted for the PEA includes 178 Mt of mill feed and 257 Mt of waste over the 24 year project life. The mill feed is comprised entirely of Measured and Indicated Resources. Approximately 21 Mt of Inferred material within the pit has been treated as waste for this study.

A PEA level mine operation design, approximately 14-year LOM production schedule, and cost model have been developed for the open pit. The in-pit resource is summarized in the following table:

Pit Delineated Resources

| Measured & Indicated Resource | Unit | Amount |

|---|---|---|

| Measured and Indicated Pit Delineated Resource | kt | 177,968 |

| Gold Grade | g/t | 0.44 |

| Measured and Indicated Gold | koz. | 2,480 |

| Silver Grade | g/t | 0.67 |

| Measured and Indicated Silver | koz. | 3,837 |

| Pit Delineated Waste | kt | 257,102 |

| Strip Ratio | t/t | 1.4 |

| Inferred Resource | Unit | Amount |

| Inferred Pit Delineated Resource (included in Waste) above) | kt | 21,226 |

| Gold Grade | g/t | 0.30 |

| Silver Grade | g/t | 0.67 |

Notes:

Cutoff gold grade of 0.15g/t calculated, and utilized in pit delineated resources.

Whole block diluted grades, with an additional 1% of block to block dilution at 0g/t gold, and 99% mining recovery, included in pit delineated resources

To maintain the assumed mill feed grades during the initial 11 years of production, a mill-feed cut-off grade of 0.3 to 0.4 g/t Au is utilized with material between the mining cut-off grade and mill feed cut-off grade being stockpiled for treatment during years 12 through 24.

Processing of the mill feed is by means of a conventional process flowsheet including primary grinding, flotation, regrinding of the concentrate, and cyanidation via a CIL circuit to produce doré. The process achieves an average overall LOM gold recovery of 89% with a recovery of 90% being achieved during the initial higher grade years. A silver recovery of 40% is assumed for the life of the project. Tailings from the plant are stored in a tailings management facility that has been designed to minimize water above the dam. The balance of the site water is managed through a separate water management pond that includes a water treatment plant for any water to be discharged.

Section 2: Capital Expenditures

The following table summarizes the estimated capital costs:

| Direct Costs | Initial Capital Cost (C$ Million) |

|---|---|

| Overall Site | 16.6 |

| Open Pit Mining | 97.3 |

| Processing Plant (including Ore Handling) | 140.0 |

| Tailing Management Facility & Water Management | 56.8 |

| Environmental | 12.0 |

| On-Site Infrastructure | 28.6 |

| Off-Site Infrastructure | 14.3 |

| Sub-Total | 365.6 |

| Indirect Costs | |

| Project Indirects | 84.6 |

| Owner’s Costs | 5.8 |

| Contingencies | 51.1 |

| Sub-Total | 141.5 |

| Total Initial Capital Cost | 507.1 |

LOM sustaining capital requirements are estimated at C$ 193.5 million.

Section 3: Operating Costs

| Area | Unit Cost (C$) |

|---|---|

| Mining ($/t mined) | $1.96 |

| Mining ($/t milled) | $4.79 |

| Processing ($/t milled) | $4.01 |

| Tailings ($/t milled) | $0.05 |

| G&A ($/t milled) | $1.09 |

| Total ($/t milled) | $9.94 |

Section 4: First Zone’s Economics

The following pre-tax financial parameters were calculated:

- 21% IRR

- 3.7-year payback on C$507 million capital

- C$597 million NPV at 5% discount value.

The following post-tax financial parameters were calculated:

- 19% IRR

- 3.7-year payback on C$507 million capital

- C$482 million NPV at a 5% discount rate.

The following parameters are used for the financial analysis throughout the life of mine:

- Gold price of US$1,250/oz.

- Silver price of US$18/oz.

- Exchange rate of US$0.75 to C$1.00.

- 99.8% payable gold and 90% payable silver.

- US$1.00/oz. gold refining charges and US$0.60/oz. silver refining charges.

- US$1.00/oz. transport charges on produced gold and silver.

- 0.15% insurance on value of produced gold and silver.

- 1.5% NSR royalty.

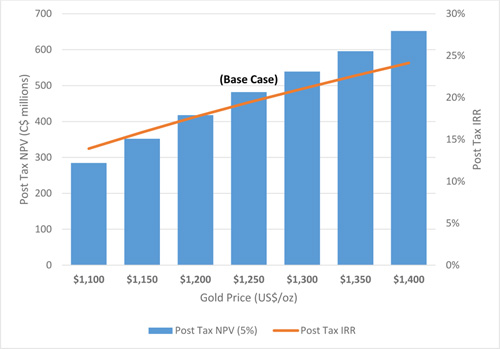

Section 5: Sensitivity to Gold Price

Section 6: The Second Zone

While the development of the balance of the geologic resource referred to as the "Second Zone" has not been incorporated into the PEA, it has the potential to benefit significantly from the infrastructure, equipment and labour put in place as a result of the development of the First Zone.

The Second Zone comprises multi-million ounces of gold contained within the current geologic resource estimate, primarily as Inferred Resources, and surrounds the pit that has been delineated for the current study. The Company believes that the Second Zone, while not included in the PEA, could deliver additional value over time by expanding or extending the Project's overall production profile. There is no assurance that all or any part of an Inferred Resource will ever be upgraded to a higher category.

Section 7: Comparisons to 2012 PEA

| 2012 PEA 100% Resource |

First Zone (Standalone Operations) |

Change | ||

|---|---|---|---|---|

| Assumed LOM Gold Price per ounce | US$ | $1,462 | $1,250 | - $212 |

| Post-tax NPV@5% | C$million | $295 | $482 | + $187 |

| Post-tax Internal Rate of Return (IRR) | 12% | 19% | + 7% | |

| Payback Period | Years | 4.4 | 3.7 | - 0.65 |

| LOM Cumulative Free Cashflow including Initial Capex (undiscounted) |

C$million | $704 | $963 | + $259 |

| Initial Capital | C$million | $764 | $507 | - $257 |

| LOM Production | koz | 2,799 | 2,210 | - 589 |

| Mine Life | Years | 14 | 24 | + 10 |

| LOM Strip Ratio | 2.3 | 1.4 | - 0.86 | |

| LOM Cash Cost per Ounce | US$ | $774 | $595 | - $179 |

| LOM AISC per Ounce | US$ | $834 | $659 | - $175 |

Section 8: Resource Estimates

The following tables summarize the total resource estimate, inclusive of the First Zone and Second Zone resources, used as the basis for the current PEA.

Table 1: Spanish Mountain Gold October 2016 Measured Resource

| Au Cut-off (g/t) |

Tonnes > Cut-off (tonnes) |

Grade > Cut-off | Contained Metal | ||

|---|---|---|---|---|---|

| Au (g/t) | Ag (g/t) | Oz. Gold | Oz. Silver | ||

| 0.15 | 45,730,000 | 0.53 | 0.66 | 770,000 | 970,000 |

| 0.20 | 38,470,000 | 0.59 | 0.66 | 730,000 | 810,000 |

| 0.25 | 32,530,000 | 0.66 | 0.65 | 690,000 | 680,000 |

| 0.30 | 27,840,000 | 0.72 | 0.64 | 650,000 | 570,000 |

| 0.40 | 20,750,000 | 0.85 | 0.64 | 570,000 | 430,000 |

| 0.50 | 15,740,000 | 0.98 | 0.65 | 500,000 | 330,000 |

Table 2: Spanish Mountain Gold October 2016 Indicated Resource

| Au Cut-off (g/t) |

Tonnes > Cut-off (tonnes) |

Grade > Cut-off | Contained Metal | ||

|---|---|---|---|---|---|

| Au (g/t) | Ag (g/t) | Oz. Gold | Oz. Silver | ||

| 0.15 | 260,800,000 | 0.37 | 0.67 | 3,110,000 | 5,650,000 |

| 0.20 | 200,370,000 | 0.43 | 0.69 | 2,780,000 | 4,450,000 |

| 0.25 | 154,710,000 | 0.49 | 0.70 | 2,450,000 | 3,470,000 |

| 0.30 | 121,410,000 | 0.55 | 0.70 | 2,160,000 | 2,730,000 |

| 0.40 | 75,280,000 | 0.68 | 0.70 | 1,650,000 | 1,700,000 |

| 0.50 | 49,310,000 | 0.80 | 0.71 | 1,270,000 | 1,120,000 |

Table 3: Spanish Mountain Gold October 2016 Measured plus Indicated Resource

| Au Cut-off (g/t) |

Tonnes > Cut-off (tonnes) |

Grade > Cut-off | Contained Metal | ||

|---|---|---|---|---|---|

| Au (g/t) | Ag (g/t) | Oz. Gold | Oz. Silver | ||

| 0.15 | 306,530,000 | 0.39 | 0.64 | 3,880,000 | 6,280,000 |

| 0.20 | 238,840,000 | 0.46 | 0.66 | 3,510,000 | 5,030,000 |

| 0.25 | 187,240,000 | 0.52 | 0.67 | 3,140,000 | 4,020,000 |

| 0.30 | 149,260,000 | 0.59 | 0.68 | 2,810,000 | 3,240,000 |

| 0.40 | 96,030,000 | 0.72 | 0.69 | 2,210,000 | 2,130,000 |

| 0.50 | 65,040,000 | 0.85 | 0.69 | 1,770,000 | 1,450,000 |

Notes:

Tonnages and Contained metals may not exactly equal individual tables due to rounding.

Whole block diluted grades shown, with no other dilution or recovery factors applied.

Table 4: Spanish Mountain Gold October 2016 Inferred Resource

| Au Cut-off (g/t) |

Tonnes > Cut-off (tonnes) |

Grade > Cut-off | Contained Metal | ||

|---|---|---|---|---|---|

| Au (g/t) | Ag (g/t) | Oz. Gold | Oz. Silver | ||

| 0.15 | 450,640,000 | 0.28 | 0.61 | 4,110,000 | 8,900,000 |

| 0.20 | 307,410,000 | 0.34 | 0.63 | 3,320,000 | 6,250,000 |

| 0.25 | 203,740,000 | 0.39 | 0.65 | 2,580,000 | 4,240,000 |

| 0.30 | 136,250,000 | 0.45 | 0.66 | 1,980,000 | 2,900,000 |

| 0.40 | 61,590,000 | 0.59 | 0.69 | 1,160,000 | 1,360,000 |

| 0.50 | 32,180,000 | 0.72 | 0.69 | 740,000 | 710,000 |

Notes:

Tonnages and Contained metals may not exactly equal individual tables due to rounding.

Whole block diluted grades shown, with no other dilution or recovery factors applied.

This Mineral Resource Estimate was prepared by Gary Giroux, P. Eng. in accordance with NI 43-101 with an effective date of October 3, 2016.

Mineral resources, which are not mineral reserves, have a great amount of uncertainty as to their existence and do not have demonstrated economic or legal viability. Inferred mineral resources have insufficient confidence to allow the meaningful application of technical and economic parameters or to enable an evaluation of economic viability suitable for public disclosure.

Section 9: Qualified Persons

The independent PEA was completed by Moose Mountain Technical Services and was prepared under the supervision of the following independent consultants:

| Qualified Person | Company | Areas of Responsibility |

|---|---|---|

| Bill Gilmour, P.Geo. | Discovery Consultants | Geology and Exploration |

| Gary Giroux, P.Eng. | Giroux Consultants Ltd. | Mineral Resource Estimating |

| Marc Schulte P.Eng. | MMTS | Lead Consultant, Mine Plan, and Capital |

| Tracey Meintjes, P.Eng. | MMTS | Metallurgy and Processing |

| Les Galbraith, P.Eng. | Knight Piésold Ltd. | Tailing, Water Management, Environmental, and Permitting |

The Spanish Mountain PEA was prepared by Moose Mountain Technical Services (MMTS) under the direction of Marc Schulte, P. Eng., a Qualified Person (as defined under National Instrument 43-101) who is independent of Spanish Mountain and has reviewed and approved this news release.

A NI 43-101 PEA Technical Report is currently being prepared by MMTS, and will be filed on SEDAR within 45 days of this news release.

About Spanish Mountain Gold

Spanish Mountain Gold Ltd is focused on advancing its flagship Spanish Mountain gold project in southern central British Columbia. The Company has adopted a two-zone project approach in which the pit-delineated high grade core (the First Zone) of the multi-million ounce resource is expected to sustain a robust stand-alone operation exceeding 24 years. The positive economics of the First Zone have been demonstrated in a Preliminary Economic Assessment. Furthermore, the Second Zone could potentially expand and extend the project’s production profile for decades. Additional information about the Company is available on its website: www.spanishmountaingold.com

On Behalf of the Board,

SPANISH MOUNTAIN GOLD LTD.

Larry Yau,

Chief Executive Officer

Inquiries:

Phone: (604) 601-3651

E-mail: info@spanishmountaingold.com

Website: www.spanishmountaingold.com

FORWARD LOOKING STATEMENTS: Certain of the statements and information in this press release constitute "forward-looking statements" or "forward-looking information" Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects", "anticipates", "believes", "plans", "estimates", "intends", "targets", "goals", "forecasts", "objectives", "potential" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements or information.

Forward-looking statements or information relate to, among other things, the timing and scope of NI 43-101 technical reports in respect of the Spanish Mountain Gold Project, including a pre-feasibility study.

Forward-looking statements or information are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements or information, including, without limitation, risks relating to: results from infill and exploration drilling, geotechnical studies, metallurgical studies, planning of tailings facilities, access to power supply, fluctuations in the spot and forward price of gold or certain other commodities; timing of receipt of permits and regulatory approvals; the sufficiency of the Company's capital to finance the Company's operations; geological interpretations and potential mineral recovery processes, changes in national and local government legislation, taxation, controls, regulations and political or economic developments in Canada or other countries in which the Company may carry on business in the future; the uncertainties involved in interpreting geological data; business opportunities that may be presented to, or pursued by, the Company; operating or technical difficulties in connection with mining activities; the speculative nature of gold exploration and development, including the risks of obtaining necessary licenses and permits; diminishing quantities or grades of reserves; and contests over title to properties, particularly title to undeveloped properties. In addition, there are risks and hazards associated with the business of gold exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks).

This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements or information. Forward-looking statements or information are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements or information due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in the Company's continuous disclosure documents under the heading "Risk Factors". Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information.

The Company's forward-looking statements and information are based on the assumptions, beliefs, expectations and opinions of management as of the date of this press release, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements and information if circumstances or management's assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements or information. For the reasons set forth above, investors should not place undue reliance on forward-looking statements and information.

Cautionary Note Regarding Mineral Resources and Mineral Reserves

Readers should refer to the Company's current technical reports and other continuous disclosure documents filed by the Company, available on SEDAR at www.sedar.com for further information the mineral resource estimates of the Company's projects, which are subject to the qualifications and notes set forth therein, as well as for additional information relating to the Company more generally.

Neither the Company, nor readers, should assume that all or any part of an inferred mineral resource will be upgraded to indicated or measured mineral resources. Most projects at the inferred mineral resource stage do not ever form the basis of feasibility or other economic studies, or achieve successful commercial production. Each stage of a project is contingent on the positive results of the previous stage and that there is a significant risk that the results may not support or justify moving to the next stage.

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.